The Fortex ECN platform lives in our dedicated facility at Equinix NY4, LD4 and HK1, where it directly aggregates Tier 1 liquidity from all major money center banks and venues. So you get real-time, direct access to interbank liquidity.

XBook ECN

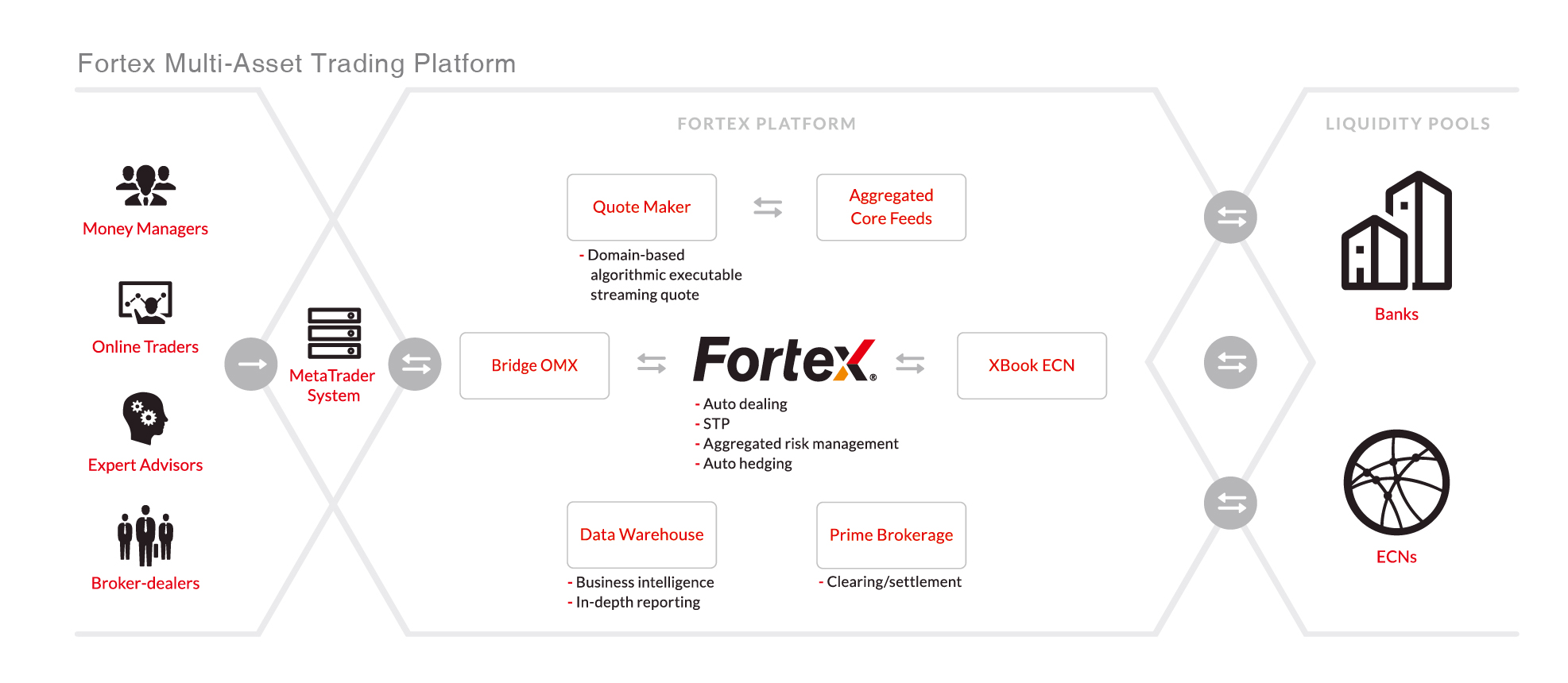

The powerful Fortex XBook matching engine works as an ECN, representing each trader’s order in the interbank market to match with the best liquidity available. Fortex has access to several superior liquidity sources that are not available to the public market. Our unique algorithm can find this hidden liquidity, enabling traders to improve pricing on large orders.

XCloud

Liquidity providers cross-connect to the Fortex XCloud server grid through dedicated dark fiber. Fortex XCloud eliminates the need for you to use the Internet, reducing round-trip trade time to sub-1ms with 480-Gbps throughput.

Bridge OMX

Fortex Bridge OMX is middleware that integrates the MetaTrader trading system with the Fortex platform for unifying global execution venues and aggregating segmented liquidity pools.

Fortex 6

Fortex 6 for desktop, web, and mobile trading puts the power of the Fortex platform in traders’ hands. It includes the AlgoX algorithmic trading engine for scripting your own automated trading strategies.

Fortex APIs

We strongly advocate system interoperability and interconnectivity. Hundreds of institutional clients use our FIX 4.4 API for trading. A web API supports integration with back-office systems for reporting, data mining, and business intelligence.