Since 1997, we’ve been the power behind select currency traders and global liquidity providers. Now we can power you too. Trade on our strength.

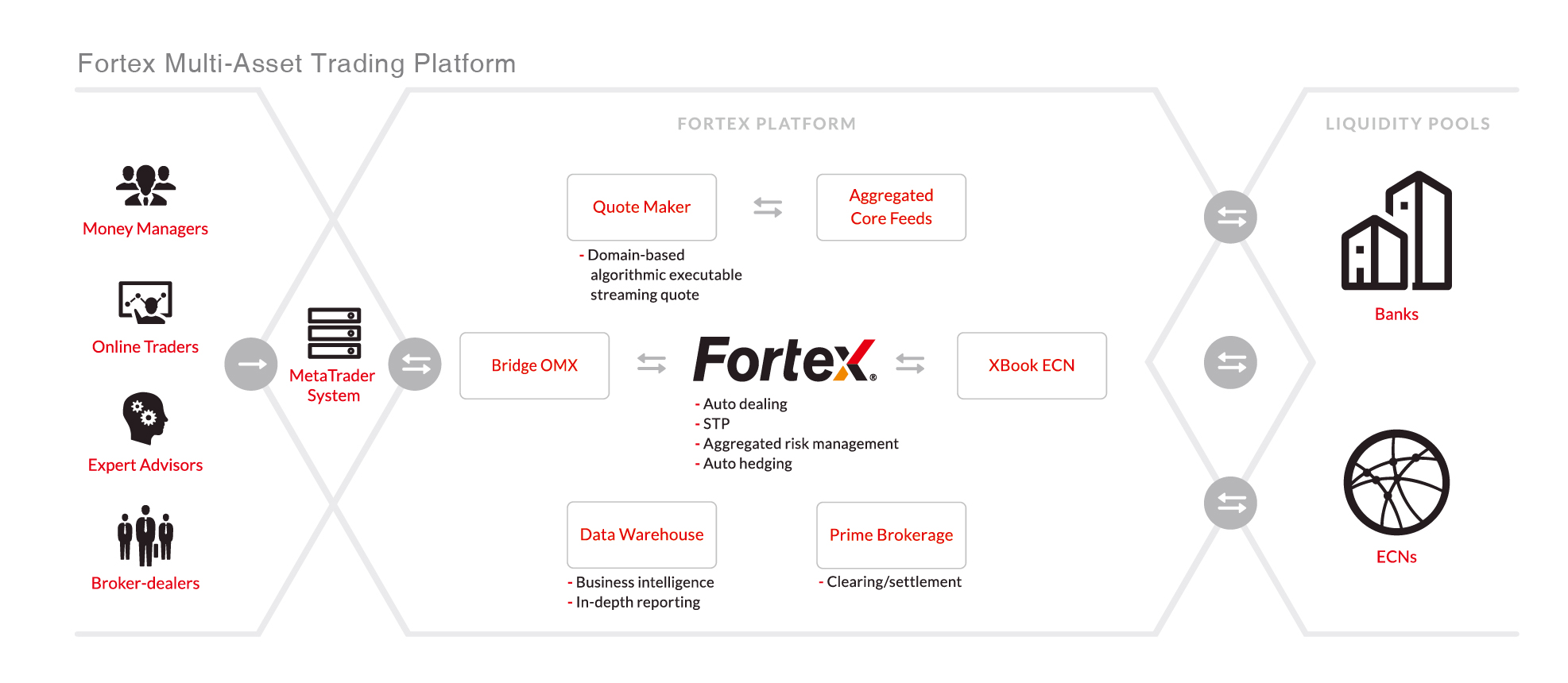

Since we launched Fortex in 1997 as a multi-asset trading platform, we have made our clients successful. Traders, broker dealers, liquidity providers, money managers, banks, hedge funds, and investors around the world rely on us to accelerate trade execution and support sophisticated trading strategies.

Founder and Executive Chairman, Advanced Markets

The Fortex ECN platform lives in our dedicated facility at Equinix NY4, LD4 and HK1, where it directly aggregates Tier 1 liquidity from all major money center banks and venues. So you get real-time, direct access to interbank liquidity.

XBook ECN

The powerful Fortex XBook matching engine works as an ECN, representing each trader’s order in the interbank market to match with the best liquidity available. Fortex has access to several superior liquidity sources that are not available to the public market. Our unique algorithm can find this hidden liquidity, enabling traders to improve pricing on large orders.

XCloud

Liquidity providers cross-connect to the Fortex XCloud server grid through dedicated dark fiber. Fortex XCloud eliminates the need for you to use the Internet, reducing round-trip trade time to sub-1ms with 480-Gbps throughput.

Bridge OMX

Fortex Bridge OMX is middleware that integrates the MetaTrader trading system with the Fortex platform for unifying global execution venues and aggregating segmented liquidity pools.

Fortex 6

Fortex 6 for desktop, web, and mobile trading puts the power of the Fortex platform in traders’ hands. It includes the AlgoX algorithmic trading engine for scripting your own automated trading strategies.

Fortex APIs

We strongly advocate system interoperability and interconnectivity. Hundreds of institutional clients use our FIX 4.4 API for trading. A web API supports integration with back-office systems for reporting, data mining, and business intelligence.

XForce E-trading Platform

XForce e-trading platform is the world's leading multi-asset e-trading platform that is neutral and open. It provides advanced trading functions and management features, including quote access, liquidity management and aggregation, risk management, business intelligence analysis, and other functions. Request a Demo Walkthrough

Direct Access to Tier 1 Liquidity

The Fortex ECN platform offers direct access to Tier 1 liquidity from all major money center banks. Gain instant, low-cost Straight-Through Processing (STP) of your orders at razor-thin spreads, as well as powerful trading features unmatched by any other FX platform on the market. Get real-time executable streaming quotes from more than 500+ liquidity providers for over 5000+ global currency pairs as well as metal, energy and CFD products.

Fortex liquidity providers include money center banks such as Bank of America, Barclays, BNP, Citi, Commerzbank, Credit Suisse, Deutsche Bank, Goldman Sachs, JP Morgan Chase, Macquarie, Morgan Stanley, Nomura, and UBS; exchanges such as CME Group; and ECNs such as Currenex, EBS, FXall, and Hotspot FX.

Powerful Trading Infrastructure

Hosted in a dedicated facility at Equinix NY4, LD4, and HK1, the Fortex platform runs on a fully redundant, carrier-class IT infrastructure for always-on availability. Hot-swap features on critical network servers and network infrastructure mean that Fortex is never taken out of service. Full redundancy combined with hot backup in Silicon Valley and a network footprint in Asia make data instantly recoverable if necessary. You get continuous, reliable performance for maximum trading performance.

Fortex enables high-velocity trading with lightning-fast speed. Liquidity providers cross-connect to the Fortex XCloud server grid through dedicated dark fiber. By eliminating Internet transport, Fortex reduces round-trip trade time to sub-1ms with 480-Gbps throughput. We easily process 10k+ of orders concurrently and more than 20 million orders per day.

XBook ECN

The powerful Fortex XBook matching engine works as an ECN, representing each trader’s order in the interbank market to match with the best liquidity available. Fortex has access to several superior liquidity sources that are not available to the public market. Our unique algorithm can find this hidden liquidity, enabling traders to improve pricing on large orders.

Artificial intelligence provides Straight-Through Processing (STP) of orders without human intervention for instant, low-cost execution. Fortex STP optimizes trading decisions across all markets by locating maximum liquidity, discovering price improvement, and minimizing market impact.

Risk Management

Easily identify and manage potential risk factors with our industry-leading robust, real-time risk monitoring and management tools. Accurately assess real-time market exposure by firm, trading domain, individual, asset class, currency pairs, or other criteria. Extensive built-in risk alerts and triggers let authorized users control risk thresholds and set systematic measures. Margin calls and margin liquidations are performed automatically. Fortex solutions also help to strictly enforce compliance risk management. You can further customize features to meet specific business practice requirements.

Back Office Support

The Fortex BackOffice web portal simplifies trade processing, settlement, account statements, reporting, regulatory filing, and system administration tasks—bridging the gap between clearing and electronic trading.

Register

Register for a free demonstration

Contact Us

Contact us to request a tour and connection

Money Center Banks

Exchanges

ECNs

ECN Brokers