Forex brokers need the appropriate tools to manage trading risks and increase returns in forex trading. Thus, we are introducing some common risk management tools, namely leverage and margin settings.

Leverage Settings and Calculation

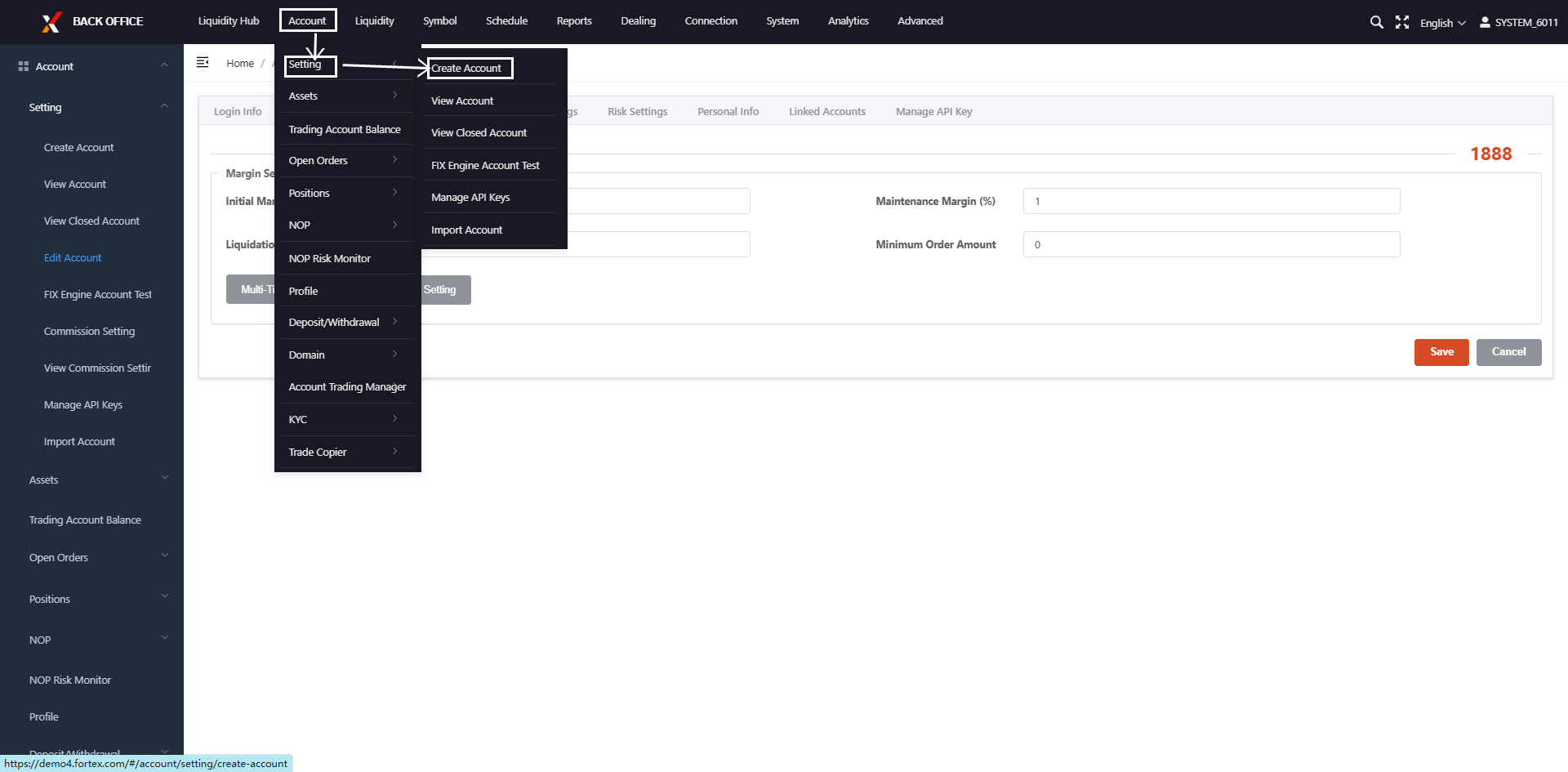

Click Account→ Setting→ Create Account, then proceed to Margin Settings

According to the screenshot, the calculation method is as follows:

Initial/Required Margin (Leverage)

The required margin to open a position, expressed as a percentage. It is a percentage of the total trade value.

Example: When you buy 1 lot EUR/USD at a price of 1.08 and the initial margin ratio is 1%, then: Initial margin = 100,000 × 1.08 × 1% = 1,080 USD

which means You must have at least 1,080 USD in Equity to open this position.

1% corresponds to 1:100 leverage.

Maintenance Margin

The threshold for triggering a margin call, expressed as a percentage. It is a percentage of the total value of open positions.

Example: When you buy 1 lot EUR/USD at 1.08 and the maintenance margin ratio is 1%, then: Maintenance margin = 100,000 × 1.08 × 1% = 1,080 USD

If account Equity drops to 1,080 USD, new positions can’t be opened. You can only close the position.

Liquidation Margin

The forced liquidation level, expressed as a percentage. It is a percentage of the total cost of open positions.

Example: When you buy 1 lot EUR/USD at 1.08 and the liquidation margin ratio is 0.5%, then: Liquidation margin = 100,000 × 1.08 × 0.5% = 540 USD

If account Equity falls to 540 USD or below, the position will be liquidated.

Real Case Examples

| Setting | Remarks |

|---|---|

| Initial Margin Ratio: 1% | Leverage 1:100 |

| Maintenance Margin Ratio: 1% | Margin Call triggered when Equity / Used Margin = 100%. No new positions can be opened. |

| Liquidation Margin Ratio: 0.7% | Forced liquidation when Equity / Used Margin = 70% |

| Setting | Remarks |

|---|---|

| Initial Margin Ratio: 0.5% | Leverage 1:200 |

| Maintenance Margin Ratio: 0.5% | Margin Call at 100%. No new positions can be opened. |

| Liquidation Margin Ratio: 0.25% | Forced liquidation at 50% Equity / Margin |

| Setting | Remarks |

|---|---|

| Initial Margin Ratio: 0.2% | Leverage 1:500 |

| Maintenance Margin Ratio: 0.2% | Margin Call at 100% |

| Liquidation Margin Ratio: 0.1% | Liquidation at 50% |

Global vs Temporary Settings at Instrument or Account Level

In some cases, a specific trading instrument may require temporary leverage settings. Please follow the above relationships when configuring Initial, Maintenance, and Liquidation Margins.

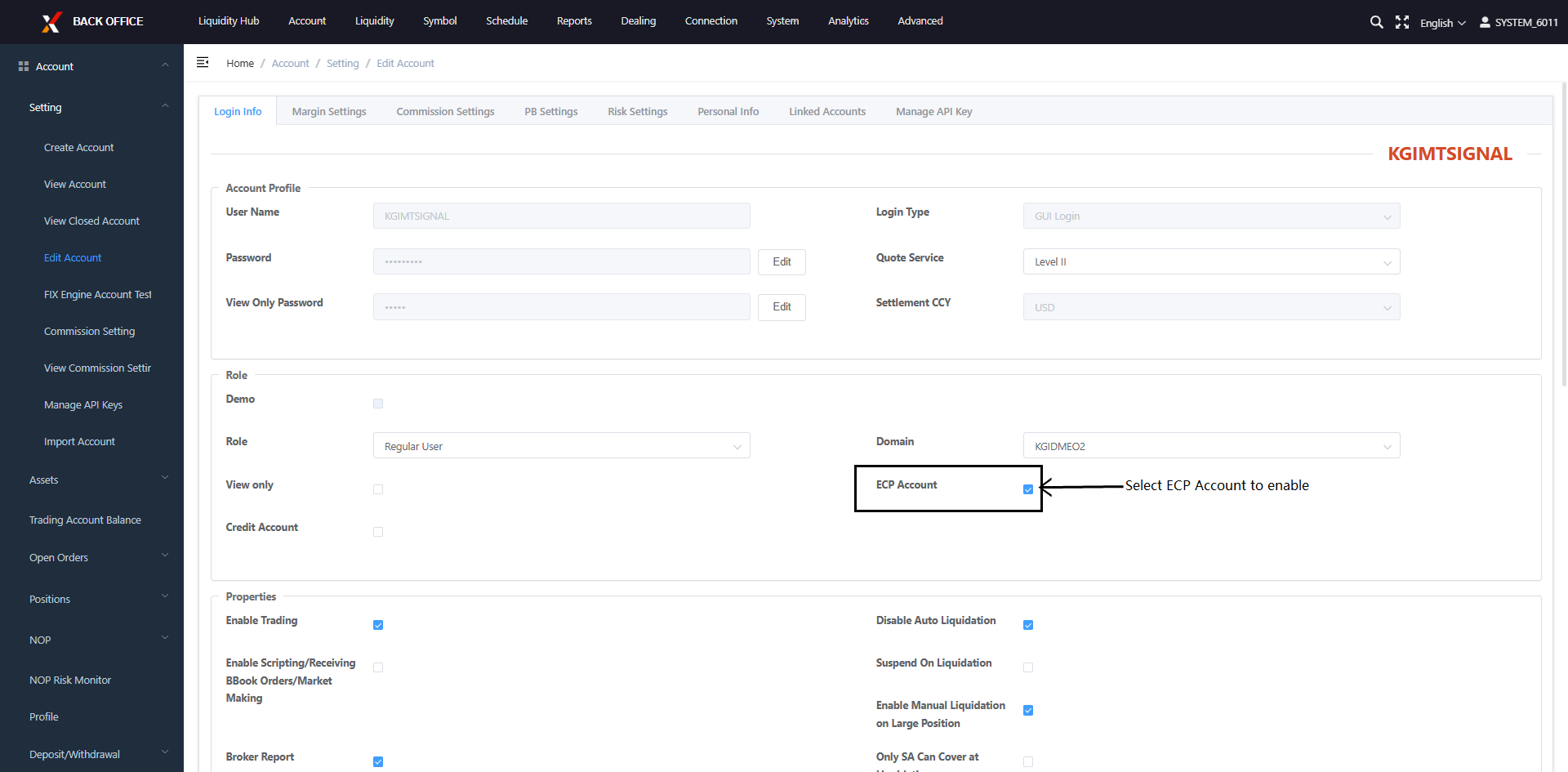

Two liquidation methods:

- Liquidation at maximum loss positions: System will liquidate the positions with the most losses first after selecting the ECP Account

- Liquidate all positions: The system will close all positions when you unselect the ECP Account

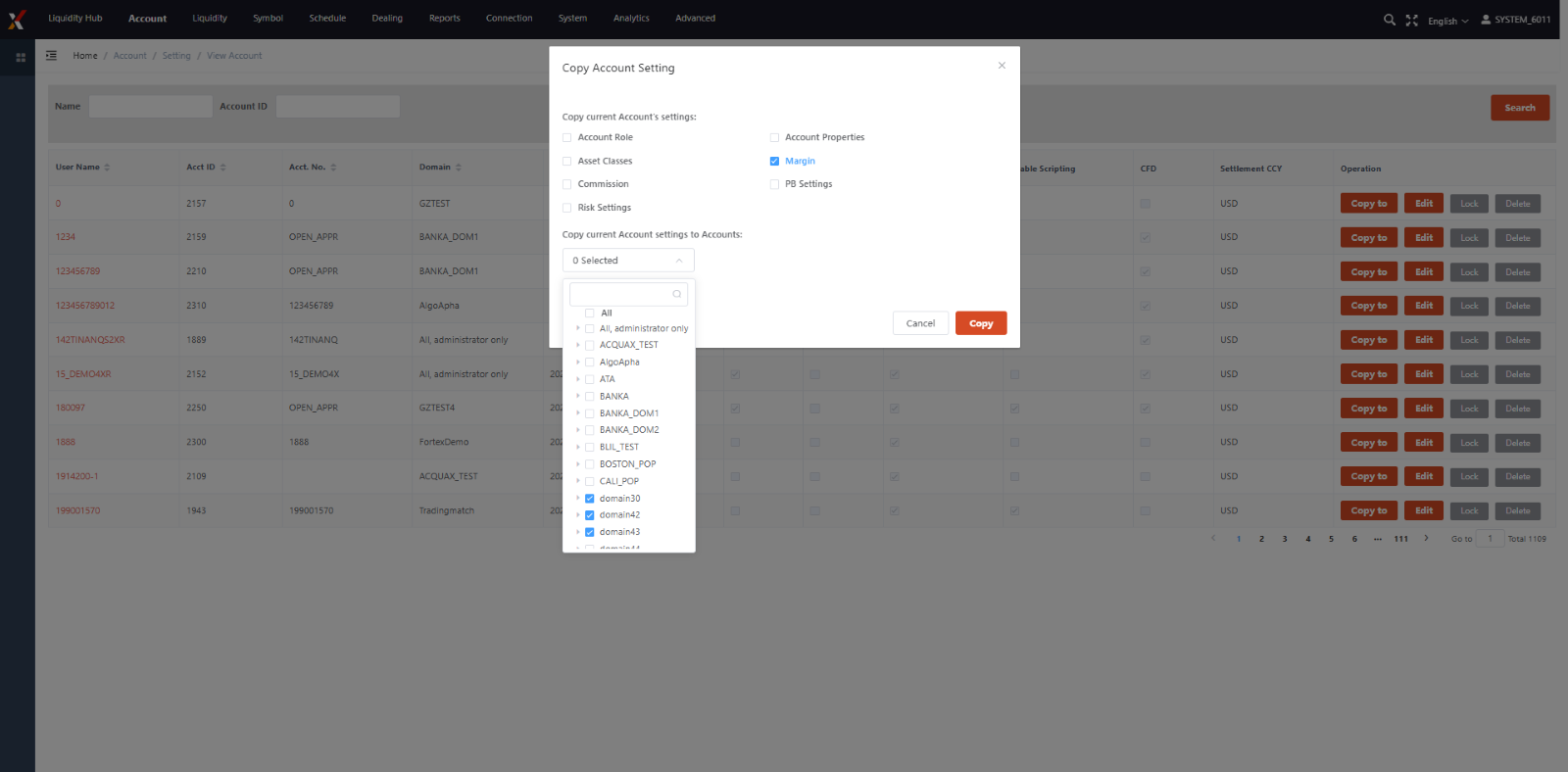

Copy Settings to Other Accounts or Domains:

Setting Retail Margin Mode:

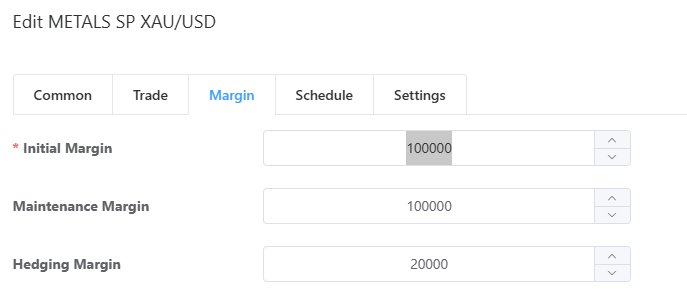

Retail Margin Mode feature is designed for brokers who want to adopt traditional brokerage margin charging model – instead of calculating margin with percentage of the trade value, which fluctuates with the current market price, it charges fixed margin value per trade lot size, regardless of the market price fluctuation.

For example, in Retail Margin Mode, the broker will set fixed margin values per lot for a symbol as below:

- Initial Margin (Required Margin): 100,000 USD/lot

- Maintenance Margin: 100,000 USD/lot

- Hedge Margin: 20,000 USD/lot

While Margin Call % and Liquidation % (Stop Out %) are defined on domain level, accounts under this domain will have the same Margin Call criteria and Liquidation criteria:

- Margin Call happens when Margin Ratio < Margin Call %

- Liquidation happens when Margin Ratio < Stop Out %

Where Margin Ratio = Equity/Sum of margin of all open positions.

There are three Fixed Margin Values that a broker can define for a symbol:

- Initial Margin

- Maintenance Margin

- Hedging Margin

Step-by-Step Guide on Retail Margin setup

Fixed Margin Values are calculated with the settings in Backoffice in Global Symbol Margin Setting and Account Margin setting.

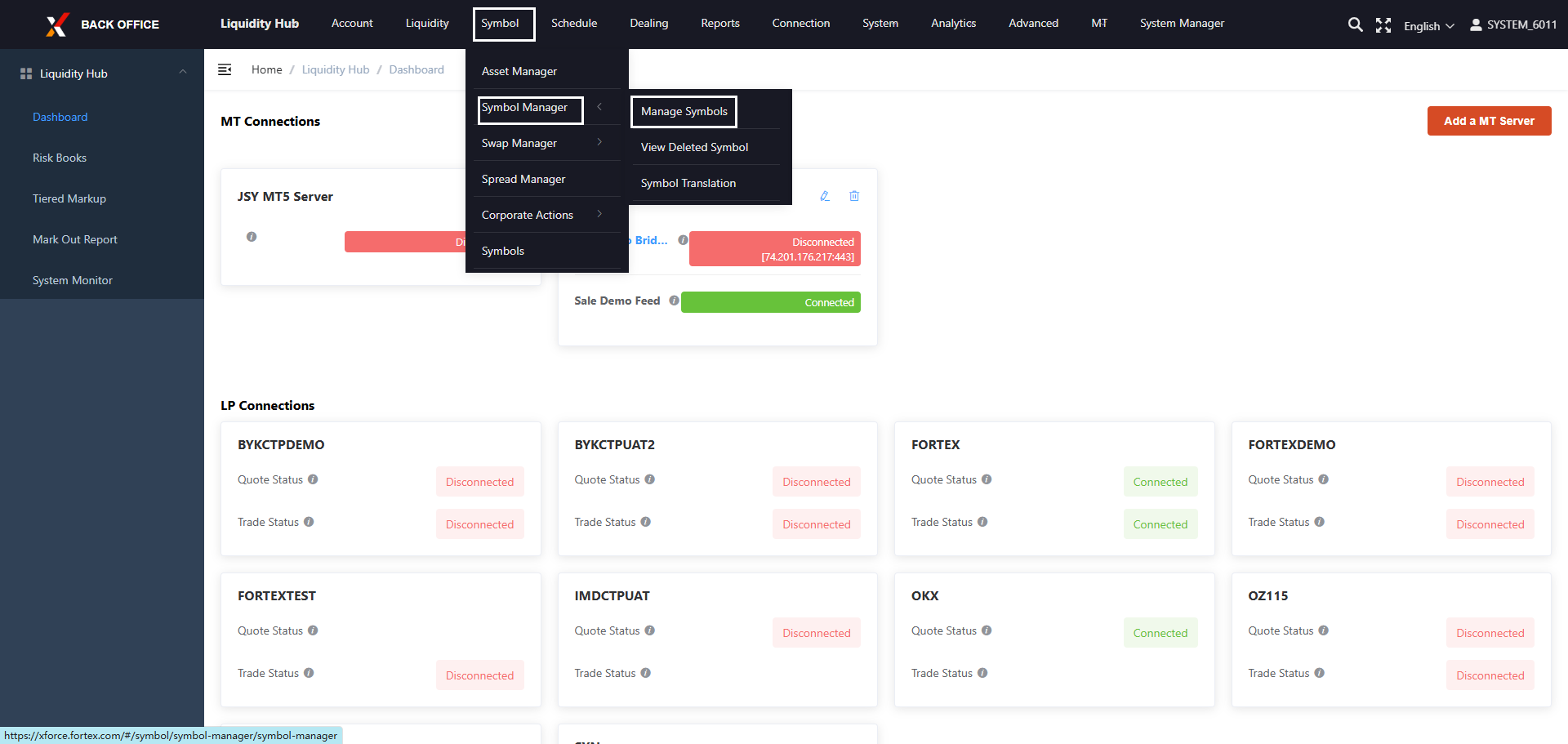

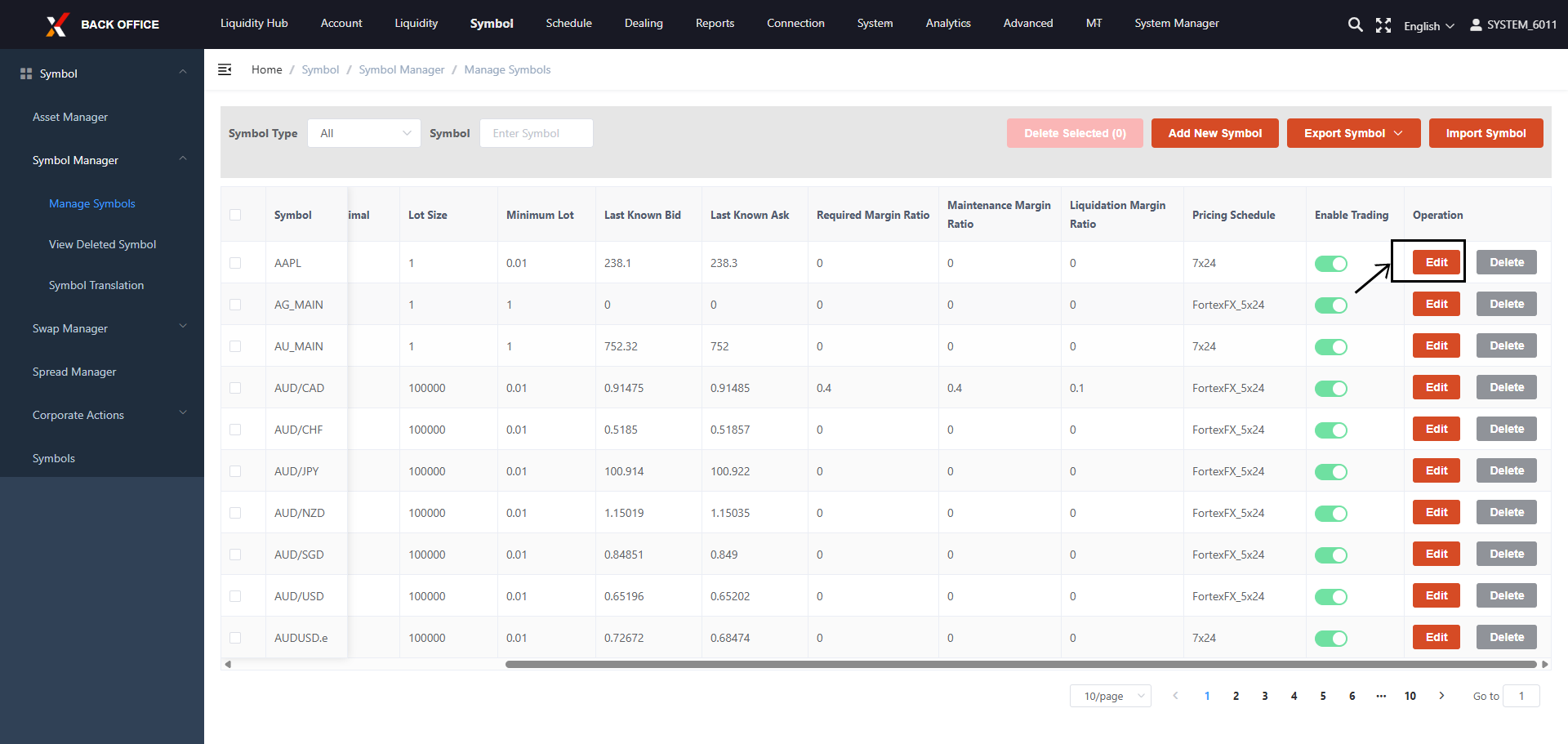

Global Symbol Margin Setting:

In Symbol – Symbol Manager – Manager Symbol – Edit a Symbol and navigate to Margin tab.

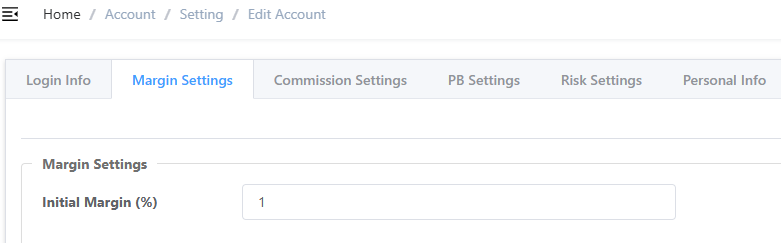

Account Margin Setting:

In Account – Setting – View Account – Edit Account – Margin Settings

Calculation:

With above example, for XAU/USD, the Fixed Margin Value calculation for the account will be as below.

- Initial Margin Value

Initial Margin Value = Position Lot Value * Account Initial Margin Ratio * Global Symbol Initial Margin

- Maintenance Margin Value

Maintenance Margin Value = Position Lot Value * Account Initial Margin Ratio * Global Symbol Maintenance Margin

- Hedge Margin Value

Hedge Margin Value = Hedge Position Lot Value * Account Initial Margin Ratio * Global Symbol Hedge Margin

Note: Hedge Margin Value only works if Enable Hedging Margin (Large Leg) is enabled in Account – Risk Settings.

Example:

Long 0.01 lot XAU/USD, short 0.1 lot XAU/USD:

- Hedge Position = 0.01 lot, Net Position = 0.09 lot

- Margin = Hedge Position Margin + Net Position Margin

= 0.01 * 1% * 20,000 USD + 0.09 * 1% * 100,000 USD

= 2 USD + 90 USD

= 92 USD

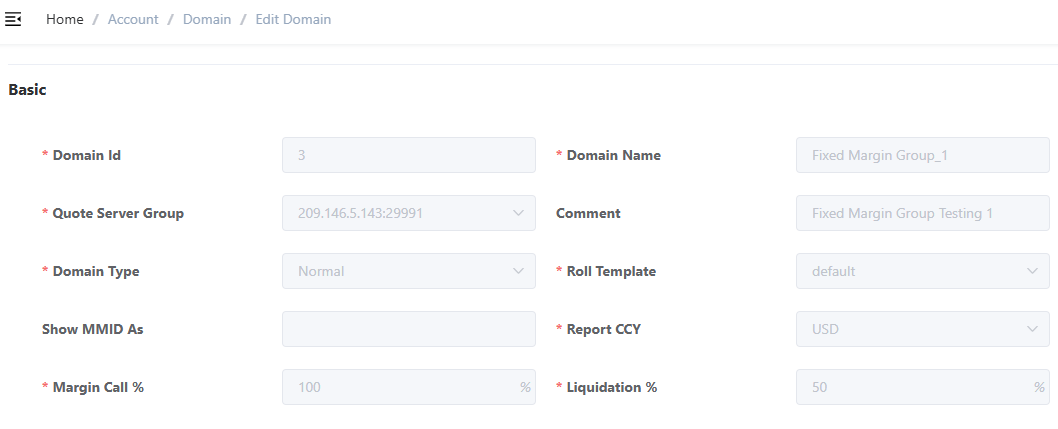

Margin Call % and Liquidation %

Margin Call % and Liquidation % are configured at Domain level in Account – Domain – View Domain – Edit Domain. They define at what Margin Ratio level that accounts under this domain will get margin call and liquidated.

Calculation

- Margin Call is triggered if: Margin Ratio <= Margin Call %

- Liquidation is triggered if: Margin Ratio <= Liquidation %

Note: Margin Ratio = Equity/Sum of Margin of all Position

API Support

This feature supports API-based creation and updates. Please refer to the relevant section in the API document.

Need some Help?

Please contact your account manager or email [email protected].